140 “XVI

.

Basis: CS [2016] No

.

Therefore, if this kind of turnbuckle scaffold is rented, although it is also responsible for on-site installation and off-site demolition, I personally think it is also unable to pay value-added tax according to construction services

.

A group of scaffolds rented by small-scale taxpayers can be invoiced at a maximum of 3%

.

This is certainly not construction equipment

.

In this case, in some areas, the tax authorities allow value-added tax to be paid according to construction services, For details, you can consult the competent tax authority; In the second case, labor and materials are contracted and subcontracts are signed

.

The contract price includes the lease price, and a total price is signed for the contract amount

.

↑ Click the “blue word” above to pay attention to our problems: Zhu boss Construction Engineering Co., Ltd

.

It can be used after installation and erection when entering the site without “continuous operation”

.

In this case, an invoice with a tax rate of 9% can be issued for “construction services”

.

In the first case, if a separate contract is signed for scaffold leasing, installation and disassembly, value-added tax cannot be paid according to construction services, and invoices with a tax rate of 9% cannot be issued

.

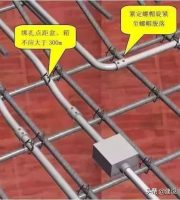

Construction equipment mainly includes: tower crane, excavator, bulldozer, attached scaffold, etc; Equipped with operators, the “operation” here also refers to the need for “continuous operation”

.

The category of “construction equipment” is directly related to the construction of the construction site

.

Party A does not accept simple tax invoices

.

(general taxpayer) has received such a project, including labor and auxiliary materials, scaffold leasing, installation and disassembly

You’d better look.

.

Read Mr

.

Author: Zhu Yanxiu of Asia Pacific Pengsheng (Qingdao) tax agent firm

.

For example, rent a car for the personnel of the project team on the construction site to facilitate their use

.

Zhu’s other articles here 👇 Is it unclear whether the special tickets obtained from simple tax items can be deducted? Looking at the comprehensive tax burden of “operating income”, will you buy tickets everywhere【 Construction tax related series 2] how to deal with the special 1% when the difference deduction is encountered? Three schemes to understand the invoicing tax rate of the construction industry! 13%, 9% and 3% of the hot training lights up

.

When Invoicing Party A, can we issue an invoice with a tax rate of 9%? Answer: there are two cases

.

Taxpayers who rent construction equipment to others and are equipped with operators shall pay value-added tax according to ‘construction services’.” The rental must be “construction equipment” and equipped with operators

.

Only value-added tax can be paid according to tangible movable property leasing services, and invoices with a tax rate of 13% can be issued

.

If the rental is a turnbuckle scaffold, this turnbuckle scaffold is an essential temporary facility in the construction process

.