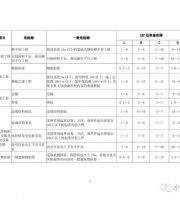

The construction projects of the enterprise shall not be disbursed as much as possible, but can be disbursed through conference expenses and other forms, so as to reduce the business entertainment expenses of the enterprise.

Those that exceed the standard can only be deducted according to the standard.

When the profit is good, the enterprise should actively plan to improve the salary standard of employees and the expenditure of relevant welfare expenses, trade union funds and employee education funds, which can improve the enthusiasm of employees on the one hand and reduce the tax burden of the enterprise on the other hand.

Reasonable wages refer to the wages paid to employees by the enterprise in accordance with the salary management system formulated by the general meeting of shareholders, the board of directors, the salary committee or relevant management institutions.

According to the requirements of high-tech enterprises, construction enterprises should actively cultivate scientific research personnel, enhance their scientific research technology, strengthen communication with the identification Department of high-tech enterprises, and strive to apply for high-tech enterprises.

The preferential tax law for high and new technology stipulates that “high and new technology enterprises that need key support from the State shall be subject to enterprise income tax at a reduced tax rate of 15%.

Once approved, the tax burden of enterprises can be greatly reduced…

By accelerating depreciation, the tax burden of taxpayers at the initial stage of using assets is reduced, and the cost of upgrading fixed assets due to technological progress is compensated.

Enterprises can plan some advertising and business publicity according to the profits of the current year, control the standards within a reasonable range, collect original materials such as invoices and materials approved by the industrial and commercial department in accordance with the requirements of the tax law, strengthen the publicity of enterprises, and improve the popularity and competitiveness of enterprises while reducing the tax burden of enterprises.

04 accelerated depreciation of fixed assets construction enterprises generally have more large-scale machinery and equipment with high value, but with the development of science and technology and rapid technological renewal, machinery and equipment are easy to be eliminated because they can’t keep up with technological renewal.

The standards shall not exceed 14%, 2% and 2.5% of the total wages respectively.

03 business entertainment tax law stipulates that the business entertainment expenses incurred by an enterprise related to production and business activities shall be deducted according to 60% of the amount incurred, but the maximum amount shall not exceed 5 ‰ of the sales (operating) income of the current year.

Employee welfare expenses, labor union expenses and employee education expenses shall be deducted according to the standard.

Therefore, the enterprise shall reasonably control the expenditure standard of business entertainment expenses according to the sales (operating) income of the current year.

Reasonable wages incurred by the enterprise are allowed to be deducted according to the facts.

Those that do not exceed the standard shall be deducted according to the actual amount.

02 the tax law on advertising expenses and business publicity expenses clearly stipulates that the qualified business publicity expenses and advertising expenses carried out by the enterprise, which do not exceed 15% of the turnover profit of the current year, can be deducted before tax, while the excess part can be carried forward and then deducted in the tax year.

The new tax law stipulates that the fixed assets of enterprises that really need accelerated depreciation due to technological progress can be treated by double declining balance method, shortening service life or year depreciation method.

How to reduce the tax burden of construction enterprises? Construction enterprises need to fully understand the pre tax deduction policies and preferential policies of enterprise income tax, which can help enterprises reasonably reduce the tax burden.

It is mainly reflected in the following aspects: 01 wages, welfare expenses, trade union funds and employee education funds.