Therefore, the rigid guarantee of social security can not solve all the problems of the enterprise.

Employer’s liability insurance for construction workers in China, the vast majority of factories and enterprises are facing the risk of personal injury and death of employees.

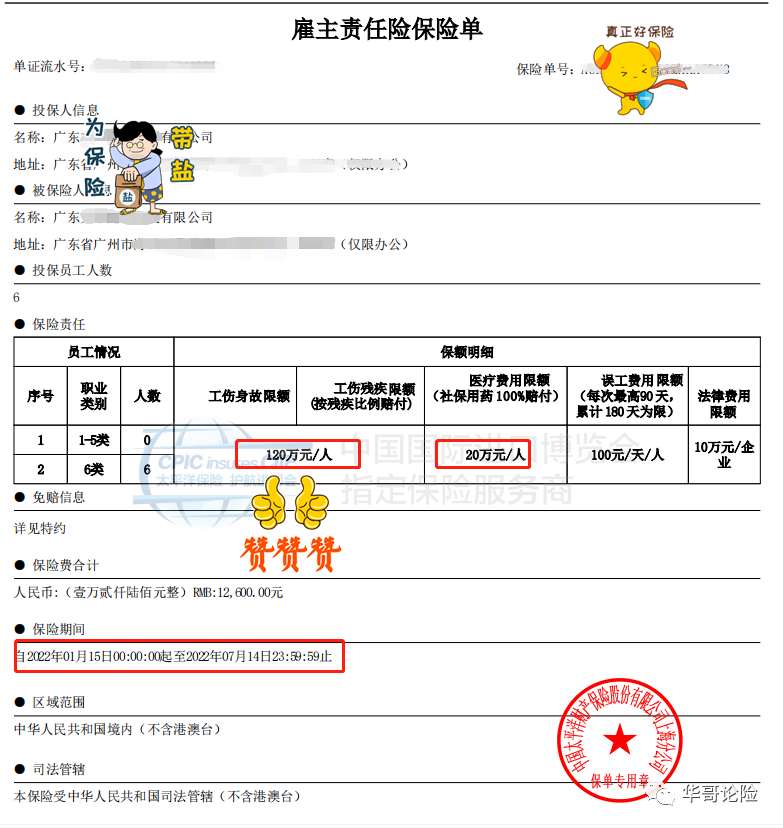

Is there any employer’s insurance specifically for the construction industry? Of course! The employer’s liability insurance for construction workers is recommended to be covered in the past..

As long as there are employee accidents during work and in the workplace, it is difficult for the enterprise to evade responsibility.

Why buy commercial insurance with industrial injury insurance? Then some bosses asked, why should I buy employer’s liability insurance when I have industrial injury insurance? Look at the figure below to help you understand the difference between industrial injury insurance and commercial insurance.

As the employer of employees – factories or enterprises, buying social security and industrial injury insurance is a mandatory requirement of the state, but industrial injury insurance is far from solving the pain points of most enterprises, because the risks faced by employees of enterprises are diverse and complex.

Because the construction industry involves high altitude, most of the general employer’s liability insurance cannot be underwritten.

Whether it is occupational disease or sudden death of employees, plus additional work delay expenses, these risks and losses have to be faced by the enterprise in the process of operation.

The employer’s liability insurance, as the “amulet” of enterprise employee protection, has always been the first choice for enterprise bosses to reduce the burden.