But the tax in the cost and the tax in the tax are really two different things———— If it is a fixed price contract, the tax in the contract price is 11, the agreed policy risk is not adjusted, and the invoice is 9 during settlement.

What length shall be used to calculate the quantities? When calculating the bill quantity, it is calculated according to the design length, that is, the effective pile length is 15.75m.

The state reduces the tax rate rather than the commodity price.

A more extreme example is a general tax project priced at 11 points, but a simple tax invoice of 3 points is issued.

Of course, the employer has the right to require reinforced concrete PC components and blocks for Party A’s supply.

Do you want to deduct two points from the price? It is not deducted, and the settlement of the price shall be in strict accordance with the contract, because the policy risks agreed in the contract are not adjusted.

In the current pricing system, the calculation rules of the two are inconsistent, which is easy to explode.

It depends on whether the ticket has been issued in the process, because it is certainly inappropriate for you to adjust the price according to 9 points for the part of the project price that has been issued according to 11 points.

The most extreme example is that the price is calculated according to 3.477 and the ticket of 11 is issued.

However, according to the provisions of CS No.

For example, if the government office buildings and schools in state-owned investment projects do not need to continue the transaction and circulation, the final settlement price shall be calculated and settled according to the contract.

Then, the contractor issues an invoice according to the fixed total price agreed in the contract, and then does not need to look at the tax in the invoice when handling the settlement, which has nothing to do with the price.

This amount can be measured.

58 document in 2017, this kind of project should be subject to simple tax calculation.

36 document in 2016, In theory, even if Party A provides a nail, the contractor can also declare the project and pay tax according to simple tax.

@ in the era of value-added tax, is the tax in the price adjusted at the time of settlement? In fact, there is no need to consult the people of the tax bureau, because they don’t understand the twists and turns of cost, just as we don’t understand the twists and turns of tax.

Chisel off the pile head when you go back to the construction of the foundation slab.

For example, real estate enterprises should be careful.

How to solve it? This is beyond the scope that the industry and the system can explain and deal with.

How the contractor pays the tax and how to calculate the tax in the price are sometimes different.

Just pay attention to whether the total invoice amount is consistent with the contract price———— If it is a fixed price contract and the policy risk is adjustable, it is not a simple deduction of tax points.

When the invoice is issued, if you see the tax of 3, you don’t need to move your eyelid at all, just look at whether the invoice amount is consistent with the settlement price agreed in the contract.

What is the difference between them? What shall prevail when calculating its quantities? The effective pile length is the length required by the structural design, that is, the design length, and the construction pile length is the pouring length required by the construction.

If there is a design, it should be calculated according to the design.

At this time, do you want to deduct 8 points from the cost? Of course, we should try our best to avoid this situation, but such deduction is not a scientific and reasonable approach.

Of course, there is also a degree.

Therefore, if the employer intends to provide a number of materials for Party A and does not want to get a simple tax invoice, resulting in the loss of input tax, it should put forward requirements for the types of invoices in the contract, that is, it is clear in the contract that your construction enterprise is to issue a general tax invoice to me, otherwise I will not accept it and bear all the consequences.

Therefore, as previously written, we should avoid these embarrassing situations and achieve the unification of price and tax and the separation of price and tax.

As mentioned above, the quota quantity is calculated according to 16m.

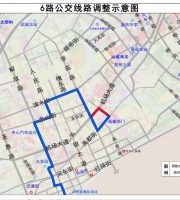

As shown below.

How to distinguish the construction length and design length of @ pile? The construction pile is 16m long and the effective pile is 15.75m long.

When calculating the quota quantity, it should be the design length plus the quota over pouring length.

If the materials supplied by Party A exceed a certain amount, it is unfair to the construction enterprise to use the general tax invoice.

The latter will also lose a large amount of input tax, resulting in the imbalance of tax burden.

Just like people who can’t wake up and pretend to sleep, many people are reluctant to face this example.

0.25m longer than the effective pile length is the over pouring length during the construction.

I just don’t know how local tax departments implement this provision, but according to the provisions of CS No.

@ how to calculate the cost of epidemic prevention and control measures in recent two years? This has brought us considerable doubts and troubles, but how to solve them? Only visas! Visa! Visa!..